Discover key small business funding solutions supporting South Africa’s small businesses and startups. Learn more today.

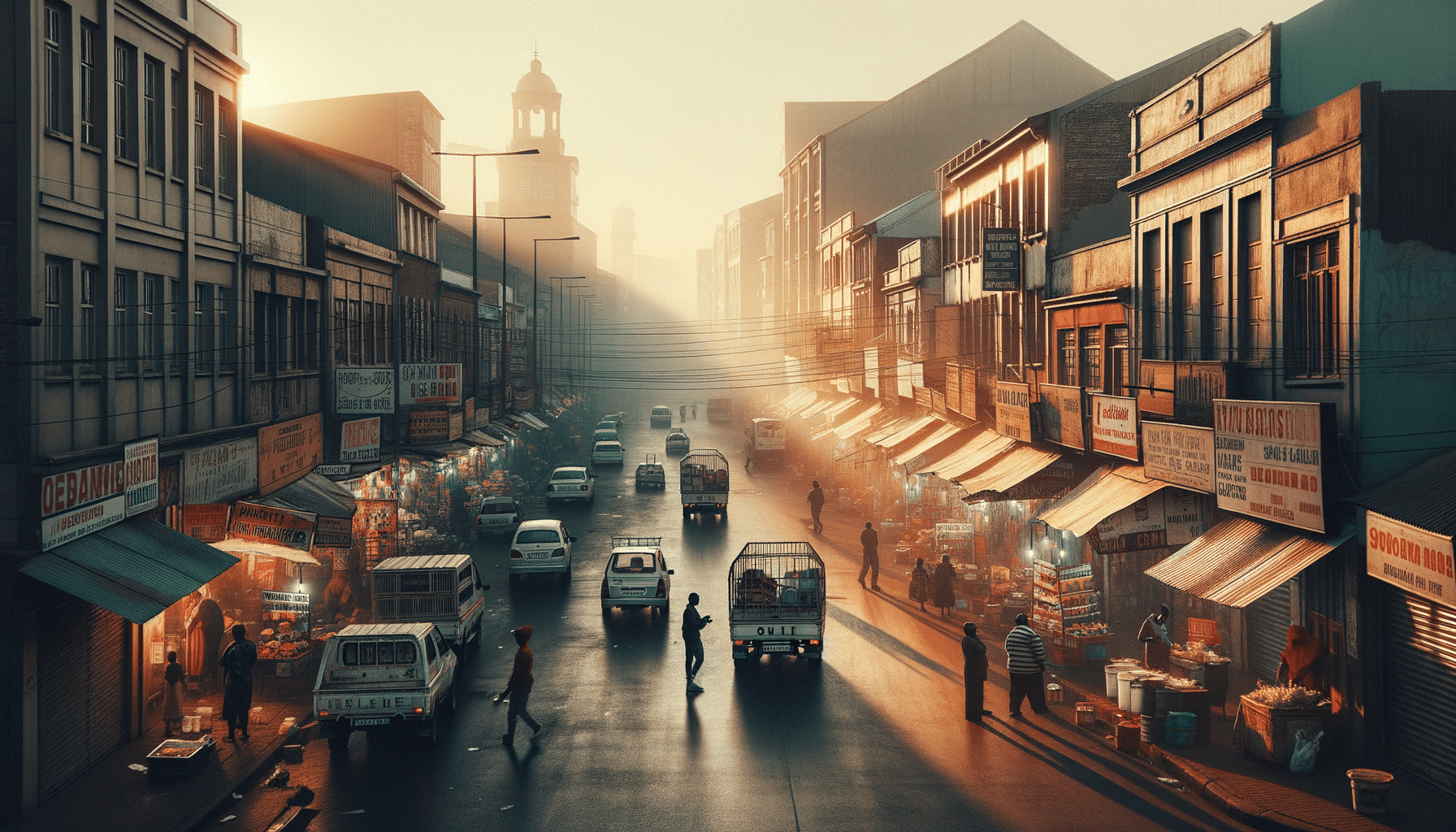

Introduction to Small Business Funding in South Africa

In the dynamic landscape of South Africa’s economy, small businesses and startups play a pivotal role in driving innovation and creating employment opportunities. However, one of the most significant challenges these enterprises face is securing adequate funding to sustain and grow their operations. Understanding the various funding options available can make a substantial difference in the success and longevity of a small business. This article delves into the diverse funding solutions available, highlighting their importance and relevance in today’s economic climate.

Traditional Bank Loans

Traditional bank loans remain a common choice for small businesses seeking capital. These loans are typically offered by financial institutions and require businesses to meet certain criteria, such as having a solid credit history and providing collateral. While bank loans can offer substantial amounts of funding, they often come with stringent repayment terms and interest rates. Small businesses should carefully evaluate their financial health and ability to meet these requirements before pursuing this option. Despite the challenges, bank loans can be a viable solution for businesses with a steady cash flow and a clear repayment plan.

Government Grants and Funding Programs

The South African government offers various grants and funding programs aimed at supporting small businesses and startups. These programs are designed to stimulate economic growth and address unemployment by empowering entrepreneurs. Government grants are typically non-repayable, making them an attractive option for startups. However, they often come with strict eligibility criteria and application processes. Businesses need to demonstrate their potential for job creation and innovation to qualify. Exploring these options can provide crucial financial support without the burden of repayment, aiding businesses in their early stages.

Venture Capital and Angel Investors

Venture capitalists and angel investors provide funding in exchange for equity in the business. This option is particularly appealing for startups with high growth potential. Venture capital firms typically invest larger sums of money and may offer valuable mentorship and networking opportunities. Angel investors, on the other hand, are usually individuals who invest smaller amounts but can provide personalized guidance and support. Both options require businesses to present a compelling business plan and demonstrate a clear path to profitability. While giving up equity can be daunting, the strategic advantages and financial backing can propel a business to new heights.

Alternative Financing Options

Beyond traditional and government-backed options, there are alternative financing methods that small businesses can explore. These include crowdfunding platforms, peer-to-peer lending, and microloans. Crowdfunding allows businesses to raise small amounts of money from a large number of people, often in exchange for rewards or early access to products. Peer-to-peer lending involves borrowing money from individuals through online platforms, often with more flexible terms than traditional bank loans. Microloans are small, short-term loans provided by non-profit organizations or community-based lenders, aimed at supporting businesses in underserved areas. These alternative options can offer greater flexibility and accessibility, especially for businesses that may not qualify for traditional loans.

Conclusion: Choosing the Right Funding Solution

Choosing the right funding solution is a critical decision for any small business or startup. Each option comes with its own set of advantages and challenges, and what works for one business may not be suitable for another. Entrepreneurs must carefully assess their business needs, financial situation, and long-term goals before deciding on a funding source. By leveraging the right funding option, small businesses in South Africa can secure the capital needed to innovate, grow, and contribute to the economy. With a well-informed approach, entrepreneurs can navigate the complexities of business funding and set their ventures on a path to success.